"When can glass substrates replace PCB boards?"

This is a question many people in the semiconductor industry who are involved in heterogeneous integration are asking. Unfortunately, the answer is not simple.

When the international investment bank Morgan Stanley reported that Nvidia's GB200 would use an advanced packaging process that employs a glass substrate, not only those in the semiconductor industry but everyone started to ask this question.

For a while, the glass substrate became the focus under the spotlight. Domestically, the concept of the glass substrate suddenly surged, and the leading stock of the glass substrate doubled in five days.

Before answering this question, let's review the history of substrate evolution. In other words, how did we get to the point where the glass substrate has become a topic of discussion?

01

What is a glass substrate?

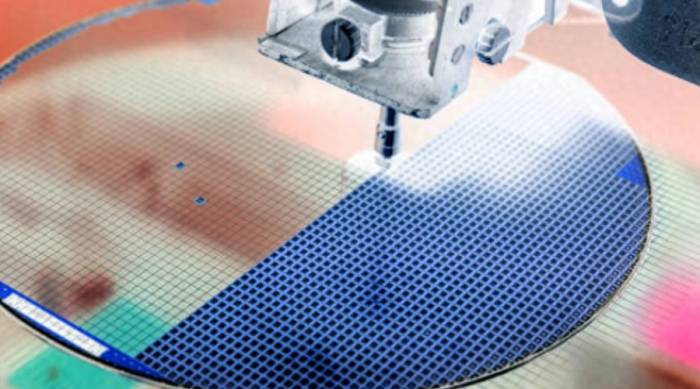

The demand for substrates began with the early large-scale integrated circuits, and as the number of transistors increased, it was necessary to connect them to more pins. The packaging substrate can provide a series of functions such as support, heat dissipation, and power supply connection for the chip during the chip manufacturing process, and it can be said to be the carrier of chip packaging.

Advertisement

Advanced packaging substrates account for more than 70% of the total packaging material cost, which shows its importance.If we extend the timeline, we will find that the substrate materials have been changing all along, from the earliest use of lead frames or metals, to the use of ceramics around the year 2000, and then it changed to organic substrates later on.

Organic substrates are essentially laminated with materials similar to PCBs and glass woven laminated boards, allowing a considerable number of signals to pass through the chip, including basic chip designs, such as Intel's mobile processors and AMD's Zen-based processors.

In 2010, the glass substrates we discuss today were proposed by the Georgia Institute of Technology as the next big thing. It was not very realistic at the time, but now it is undeniable that many companies have started to believe that glass will become the material for substrates in the next generation.

Why is that?

Because organic substrates have become a limiting factor for high-performance chips. In the past decade, the rise of ultra-high-density interconnect interfaces has led to the emergence of silicon interposers (chips on wafers on substrates) and their derivatives, as well as TSMC's CoWoS technology and Intel's EMIB technology. However, the cost is quite high, and it cannot completely solve the shortcomings of organic substrates.

The advantages of glass substrates are very prominent:

First, the main component of the glass substrate is silicon dioxide, which is more stable at high temperatures. This makes the glass substrate more capable of effectively dealing with high temperatures and managing the heat dissipation of high-performance chips. This brings excellent thermal stability and mechanical stability to the chips.

Second, compared to traditional plastic substrates, glass substrates are flatter, which makes packaging and photolithography easier. In terms of data, glass substrates can reduce pattern distortion by 50%, thereby improving the focus depth of photolithography, and thus ensuring that semiconductor manufacturing is more precise and accurate.

Third, due to these unique characteristics, glass substrates can achieve a higher interconnect density. This is very important for power transmission and signal routing in the next generation of packaging, which can connect more transistors in the package. The interconnect density on glass substrates can be increased by 10 times.These three points address the current challenges in advanced packaging, making them suitable for chips in the HPC and AI fields that require the integration of more transistors and have higher demands for heat resistance and flexibility.

Especially as the semiconductor industry is shifting towards chiplet technology, which integrates multiple chips into one package, glass substrates will also play a significant role.

This is where the discussion of glass substrates comes in.

Simply put, a glass substrate is a replacement of organic PCB-like materials with glass. Of course, this does not mean replacing the entire substrate with glass, but the core material of the substrate will be made of glass. At the same time, the metal redistribution layer (RDL) will still exist on both sides of the chip, providing an actual passage between various pads and solder points.

02

Is mass production of glass substrates possible?

As mentioned earlier, the concept of glass substrates has recently been hyped, and there are even reports that Nvidia's GB200 may use advanced packaging processes with glass substrates. This raises the question, is mass production of glass substrates possible?

Finding the answer to this question is simple; we can directly see if the leaders in this field can mass-produce to answer. In this field, the earliest research company is Intel, which started laying out about ten years ago. It has now established a fully integrated R&D production line for glass substrates in a factory in Chandler, Arizona (the factory producing EMIB). The investment in R&D related to glass substrates has exceeded 1 billion US dollars.

Intel's product launch plan for glass substrates is in 2030. In Intel's statement, it is said: It is expected to provide a complete glass substrate solution to the market in the second half of this decade, enabling the industry to continue advancing Moore's Law after 2030.In a nutshell, the leading company in this field is currently unable to mass-produce glass substrates.

When the reporter reviewed the report from Morgan Stanley, it did not mention that GB200 would use glass substrates, and the report only stated that "there is an opportunity for glass substrates to be widely used in GPUs." This does not mean that semiconductor glass substrate packaging can be officially mass-produced and used.

In response to the recent popularity of the glass substrate concept, many listed companies have responded to the layout of glass substrate technology.

Lei Man Guang Dian, whose stock price soared, announced that after self-examination, the glass substrate packaging technology in external information refers to the use of glass substrates to replace traditional organic polymer substrates for semiconductor chip packaging, which belongs to the application field of semiconductor chip packaging. The company's new PM driving glass substrate packaging technology is mainly used for packaging of Micro LED display panels and cannot be used for semiconductor chip packaging.

Wo Ge Guang Dian said: "Recently, according to relevant media information, the company has been included in the concept stocks of glass substrates. After self-examination, the company's glass substrate TGV products currently do not have the ability to mass-produce and have not formed business income. Please invest rationally and pay attention to the risks of concept speculation."

As a leading supplier of packaging substrates, Shen Nan Circuit said that there are differences in material characteristics and production processes between glass substrates, PCBs, and organic packaging substrates, and they each have different characteristics in their respective application fields. The company maintains close attention and research on glass substrate technology, but is not currently involved in the production of glass substrates.

In fact, the domestic glass substrates are more used for Mini/Micro LEDs, rather than the packaging field of semiconductor integrated circuit chips.

03

Who is laying out the glass substrates?

Although the "glass substrate" in China is not the "glass substrate" referred to by Intel, it is undeniable that in the field of semiconductors, glass substrates are indeed a candidate for the next generation of substrates.According to recent research by MarketsandMarkets, the global glass substrate market is expected to grow from $7.1 billion in 2023 to $8.4 billion by 2028, with a compound annual growth rate (CAGR) of 3.5% from 2023 to 2028. Under the trend of AI, several major manufacturers, including Intel, AMD, and Samsung, have publicly expressed their entry into the glass substrate packaging market.

The "CHIPS Act" passed in the United States has announced funding for the research and development and production of semiconductor glass packaging. It has already invested $75 million in Absolics and SK Hynix under SK Group. The official website of Absolics shows that Absolics glass substrates provide differentiated value such as high performance/low power consumption/size for HPC-related packaging companies, data centers, AI, etc. Applied Materials has also invested about $40 million in Absolics.

Samsung naturally cannot watch Intel's glass substrate business stand out, and finally announced the acceleration of the development of glass substrate chip packaging this year. In March 2024, Samsung Electronics, a subsidiary of Samsung Group, announced the establishment of a joint research and development team (R&D) with Samsung Electronics and Samsung Display. Samsung Electronics is expected to focus on the integration of semiconductors and substrates, while Samsung Display will handle aspects related to glass processing to develop and commercialize glass substrates as quickly as possible.

In addition, a senior executive of LG Innotek also said that LG Innotek is considering the development of glass substrates for chip packaging. Its general manager, Jaeman Park, believes that glass is very likely to become the main component of future semiconductor packaging substrates.

At the same time, according to market news, Apple is actively discussing with multiple suppliers the application of glass substrate technology in chip development to provide better heat dissipation performance, allowing chips to maintain peak performance for a longer period.

Japan is also starting to pay attention to this emerging technology. Japan Printing (DNP) announced in March last year that it has successfully developed a TGV glass core substrate. The report said that the substrate replaces traditional resin substrates such as FC-BGA, providing higher performance for semiconductor packaging than existing technology-based semiconductor packaging.

DNP has set a goal to mass-produce TGV glass core substrates in 2027. DNP expects companies like Intel to adopt this technology and estimates that by the fiscal year 2030, the revenue generated by substrates for semiconductor packaging may reach 3 billion yen ($200 million).

04

There are many challenges

There are still many unresolved issues with glass substrates at present.Rahul Manepalli, a research fellow and director of Intel's Substrate TD Module, said: "Glass is a means of achieving an interconnect density very similar to that of a silicon interposer. Glass substrates can achieve this function, but they also bring very challenging integration and interface engineering issues that we must address."

These various challenges include the fragility of glass substrates, lack of adhesion to metals, and difficulty in achieving uniform via filling. Moreover, glass has high transparency, and the different reflectivity from silicon makes inspection and measurement a problem that needs to be solved. Specifically, optical metrology systems that rely on reflectivity to measure distance and depth must adapt to the semi-transparency of glass, which can lead to signal distortion or loss, thereby affecting measurement accuracy.

In addition, the lack of reliability data in the popularization of glass substrates is also a stumbling block. Glass substrates are new entrants in the field of semiconductor packaging, and compared with traditional materials such as FR4, polyimide, or Ajinomoto Build-up Film (ABF), there is relatively little long-term reliability information, which requires decades of data to establish standards, performance indicators, and expected lifespans.

The reliability data of glass substrates cover a variety of factors, including mechanical strength, resistance to thermal cycling, hygroscopicity, dielectric breakdown, and stress-induced delamination. Each of these characteristics can have a profound impact on the performance of the final product, especially under extreme or variable conditions.

Overall, glass substrate packaging is indeed recognized as the "next-generation technology," but the glass substrate packaging industry for semiconductors is still in its infancy. When the glass substrate will truly start to capture the market, whether it will replace organic substrates, and who will stand out in the industry chain are still unknown.